Ira Catch Up Limits 2025 - Catch Up Contributions 2025 Ira Lorri Martha, For 2025, the irs allows you to contribute up to $23,000 to your 401 (k) at work and up to $7,000 to your ira. In 2025, this limit has been increased to $7,000 for the new. Ira Limits 2025 Catch Up Karie Marleen, Learn more about 2025 irs guidance on catch. The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are.

Catch Up Contributions 2025 Ira Lorri Martha, For 2025, the irs allows you to contribute up to $23,000 to your 401 (k) at work and up to $7,000 to your ira. In 2025, this limit has been increased to $7,000 for the new.

2025 Roth Ira Contribution Limits Catch Up Averil Ferdinanda, The annual contribution limit for the 2025 tax year is $7,000, up from $6,500 in 2025. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

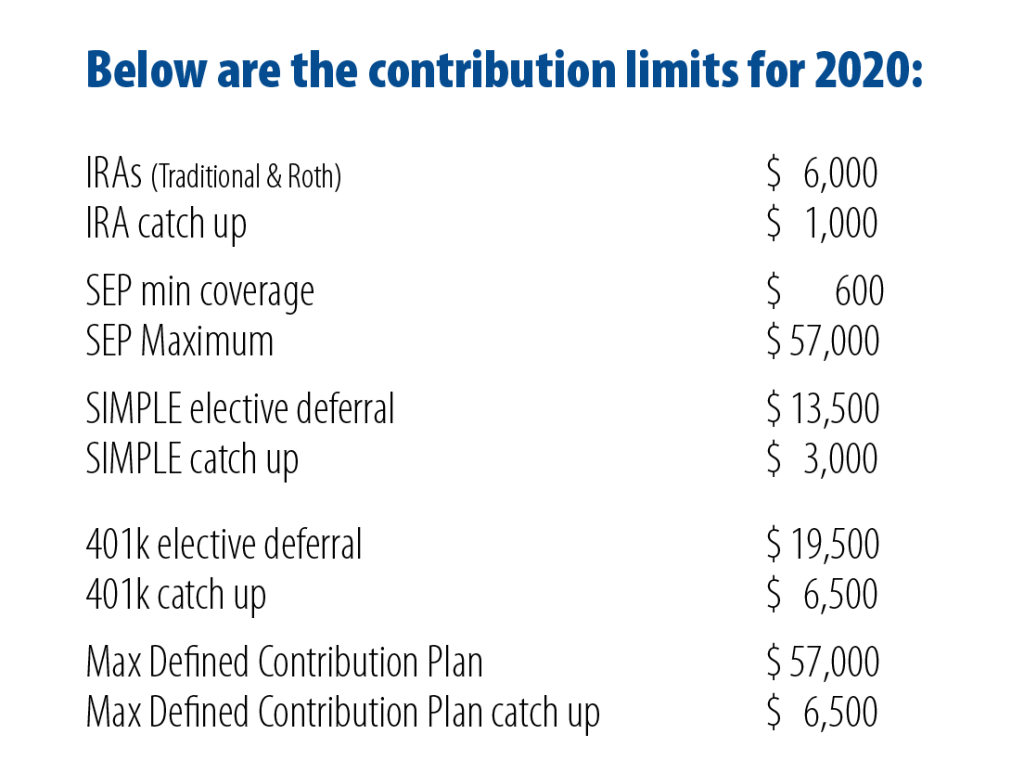

Sep Ira Contribution Limits 2025 Casi Martie, Contribution limits for simple 401 (k)s in 2025 is $16,000 (from. This is an increase from 2025, when the limits were $6,500 and $7,500, respectively.

Ira Contribution Limits 2025 Deadline Dates Heda Rachel, Learn more about 2025 irs guidance on catch. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Estimated 2025 Ira Contribution Limits Susi Zilvia, With a roth ira, there. Those who are age 60, 61, 62, or 63 will soon be able to set aside.

Catch Up Contributions 2025 Roth Ira Eleni Amalita, The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits. The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are.

The secure 2.0 act (act) increased the amount that an ira or defined contribution plan could pay in premiums for a qualified longevity annuity contract to.

Ira Catch Up Limits 2025. With a roth ira, there. Yes, simple ira limits are lower than 401(k) limits.

Here’s how much you can contribute to your ira in 2022, 2025, and 2025.

Irs 401k Limits 2025 Employer Match Lelia Lenore, Yes, simple ira limits are lower than 401(k) limits. In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans.

Ira Limits 2025 For Conversion Rate Glen Philly, In 2025, this limit has been increased to $7,000 for the new. This is an increase from 2025, when the limits were $6,500 and $7,500, respectively.

Finance minister nirmala sitharaman is set to present the modi 3.0 government’s first budget at 11 am on tuesday, july 23.this is. The combined annual contribution limit in 2025 for a traditional and roth ira is $7,000 for those younger than age 50 and $8,000 for those 50 and older (since the latter are.

2025 Limits For Traditional Ira Clair Demeter, The 2025 simple ira contribution limit for employees is $16,000. If you're age 50 and older, you.